Family Office in Malaysia: Why You Must Know This Now (2026 Outlook)

The global family office sector is expanding rapidly — and Malaysia is now positioning itself as one of Asia’s next major family office hubs. From 0% tax incentives to the new Special Financial Zone, 2026 marks a critical turning point.

Here’s everything you need to know about why Family Office in Malaysia is gaining attention now, what opportunities exist, and why talent and readiness remain key challenges.

Global & Asia Family Office Market: The Shift

The global family office sector has grown significantly, managing approximately $3.1 trillion in assets (2024), with projections estimating an increase to $5.4 trillion by 2030.

Notably, the Asia-Pacific region has surpassed Europe in the number of family offices, hosting 2,290 compared to Europe’s 2,020. This highlights Asia’s rising prominence in wealth creation and long-term family governance.

Asia is now the fastest-growing region for ultra-high-net-worth families, driving new demand for advisors, governance experts, and compliant wealth structures.

Why 2026 Is a Pivotal Year for Malaysia

In Malaysia, 2026 marks a turning point. The Madani Government has introduced the Family Office Incentive Scheme and established the Forest City Special Financial Zone (SFZ), signaling a strong commitment to positioning Malaysia as a competitive family office hub in Southeast Asia.

Below are the key reasons why understanding the family office landscape in Malaysia matters now.

1) Malaysia’s Government Focus: The New Family Office Incentive Scheme

On 20 September 2024, the Malaysian government launched a new Family Office Incentive Scheme under the Forest City Special Financial Zone (SFZ), offering a 0% tax rate for up to 20 years to eligible Single Family Office Vehicles (SFOV1).

| Key Benefits | Description |

|---|---|

| Zero Percent Tax Rate | 20-year tax exemption on income from eligible investments |

| Strategic Location | Must operate within Forest City SFZ with future-ready infrastructure |

| AUM Requirement | Minimum RM30 million assets under management |

| Local Investment | At least 10% of AUM or RM10 million invested locally |

| Operational Spending | Minimum RM500,000 annual OPEX in Malaysia |

For full guidelines, visit the Securities Commission Malaysia announcement .

These incentives raise an important question: Does Malaysia have enough talent, advisory readiness, and ecosystem support to manage the incoming and existing wealth? Today, the answer is largely — not yet.

If you are exploring an international family office, one of Asia’s top firms has now set up in Malaysia. You may make an appointment to speak with their consultant.

2) Family Office Opportunity Cost (Global Examples)

Globally, family offices demonstrate massive long-term gains in wealth preservation, governance, and tax optimisation. Here are real examples showing why they matter:

- Eduardo Saverin (Facebook Co-Founder): After moving to Singapore and setting up his family office, he reportedly saved $288 million in taxes — showing how strategic structuring can deliver significant advantages.

- Kuok Meng Xiong (K3 Ventures): Linked to the Kuok family office in Singapore, K3 invested early in companies like ByteDance and Grab — demonstrating how family offices can accelerate tech innovation in the region.

- Joseph Tsai (Alibaba Co-Founder): His family office purchased the Brooklyn Nets for $3.5B (2019). By 2024, the team was valued at $4.8–$5.6B — a gain of up to $2.1B in 5 years.

If you are exploring strategic wealth structuring, you may want to review: How to Set Up an Offshore Trust in Malaysia .

3) Asia’s Wealth Boom & the Growing Talent Gap

By 2027, Asia is expected to have approximately 210,000 ultra-high-net-worth individuals (UHNWIs), each with at least USD 30 million (RM141 million) in wealth. This reflects a growth of nearly 40% from 2022.

With this surge, Asia’s demand for governance advisors, succession planners, trust specialists, and multi-jurisdiction wealth experts is outpacing supply — especially in Malaysia.

This widening talent gap creates opportunities for advisors, financial planners, lawyers, trust officers, and next-gen owners to upskill.

Global Wealth Owners Choosing Asia Hubs

Many high-net-worth individuals in Asia manage their wealth through family offices located in Singapore or Hong Kong. Below is a snapshot of notable individuals with Asia-based family offices:

| Name | Net Worth (2025) | Description | Country | Industry | Family Office Name | Major Investments | Philanthropy | Year Established | Education | Awards |

|---|---|---|---|---|---|---|---|---|---|---|

| Sergey Brin | $143 billion | Co-Founder of Google | Singapore | Technology | Brin Family Office | Real estate, AI startups | Brin Wojcicki Foundation | 2005 | Stanford University | Marconi Prize, National Medal of Technology |

| Mukesh Ambani | $104 billion | Chairman of Reliance Industries | Singapore | Energy, Retail | Reliance Family Office | Oil, telecom, retail | Reliance Foundation | 1981 | Institute of Chemical Technology | Business Leader of the Year |

| Liang Xinjun | $2.3 billion | Co-founder of Fosun Group | Singapore | Investment | Fosun Family Office | Healthcare, real estate | Fosun Foundation | 1992 | Fudan University | Top 10 Chinese Entrepreneurs |

| Ray Dalio | $15.4 billion | Founder of Bridgewater Associates | Singapore | Finance | Dalio Family Office | Hedge funds, global real estate | Dalio Foundation | 1975 | Harvard Business School | Philanthropist of the Year |

| Jack Ma | $27.2 billion | Founder of Alibaba Group | Hong Kong | Technology, E-commerce | Lakeside Partners | E-commerce, fintech, AI | Jack Ma Foundation | 1999 | Hangzhou Normal University | Asia’s Heroes of Philanthropy |

| Li Ka-shing | $31.0 billion | Hong Kong business magnate | Hong Kong | Conglomerate | Horizon Ventures | Biotech, real estate, tech | Li Ka Shing Foundation | 1950 | None | Grand Bauhinia Medal |

| Joseph Tsai | $12.1 billion | Co-Founder of Alibaba Group | Hong Kong | Technology, Investment | Blue Pool Capital | Sports franchises, private equity | Tsai Foundation | 2012 | Yale University | Business Person of the Year |

| James Dyson | $15.1 billion | Founder of Dyson | Singapore | Technology, Consumer Goods | Weybourne Group | Tech, robotics, property | James Dyson Foundation | 2013 | Royal College of Art | Order of Merit, Royal Designer for Industry |

Many wealthy Malaysians currently structure their wealth abroad due to Malaysia’s talent gap and limited family office ecosystem. CEOs in Asia’s family office sector earn between SGD 158,001 and SGD 500,000 annually (KPMG) — excluding bonuses — reflecting the specialised nature of the industry.

FIAM is committed to helping Malaysia close this gap by training advisors with international family office experts. Subscribe below to receive updates on family office Malaysia, offshore trusts, and inheritance planning.

4) Malaysia Redefines Minimum Net Worth for Family Offices — RM10 Million AUM

Traditionally, establishing a family office required high entry thresholds:

- Singapore: SGD 10 million (≈ RM35 million)

- Hong Kong: HKD 240 million (≈ RM140 million)

In contrast, Malaysia — through the Labuan International Business and Financial Centre (Labuan IBFC) — now allows family office structures with a minimum of just RM10 million AUM.

This policy change is expected to:

- Encourage more Malaysian entrepreneurs to adopt formal wealth structures

- Attract regional families seeking cost-effective jurisdictions

- Increase demand for financial, legal, tax, and succession planning services

- Boost awareness of governance and wealth preservation practices

5) Malaysia’s Family Office Sector Is Accelerating — From RM400 Million to RM2 Billion

Malaysia’s family office expansion is already underway. According to The Star, the Securities Commission (SC) reported that Malaysia’s Single Family Office assets under management reached RM400 million in 2025.

Powered by clearer SC guidelines and the 0% tax incentive from the Forest City Special Financial Zone (SFZ), Malaysia is rapidly becoming an attractive destination for wealth owners.

Even more striking, the SC targets RM2 billion in SFO AUM by 2026 — a fivefold leap in just one year.

This shows that Malaysia is no longer “planning” to enter the global family office arena — it is already scaling and attracting serious interest.

6) Tailored for New Wealth: Crypto, NFTs & Digital Assets

Modern family offices are expanding beyond traditional assets. Today’s portfolios increasingly include crypto holdings, NFTs, tokenised assets, and digital art.

Malaysia’s regulatory openness and flexibility position it as a promising jurisdiction for families who want secure, compliant ways to structure emerging digital wealth.

As digital assets become mainstream, Malaysia’s early framework gives it a competitive edge among Asian financial centres.

Understanding Family Offices

A family office is a private wealth management advisory firm that serves ultra-high-net-worth investors. Family offices are distinct from traditional wealth management shops in that they offer a total outsourced solution to managing the financial and investment side of an affluent individual or family.

History: The concept began with the Rockefeller family in the late 19th century, who pioneered this approach to consolidate management of the family’s sprawling empire under a single office.

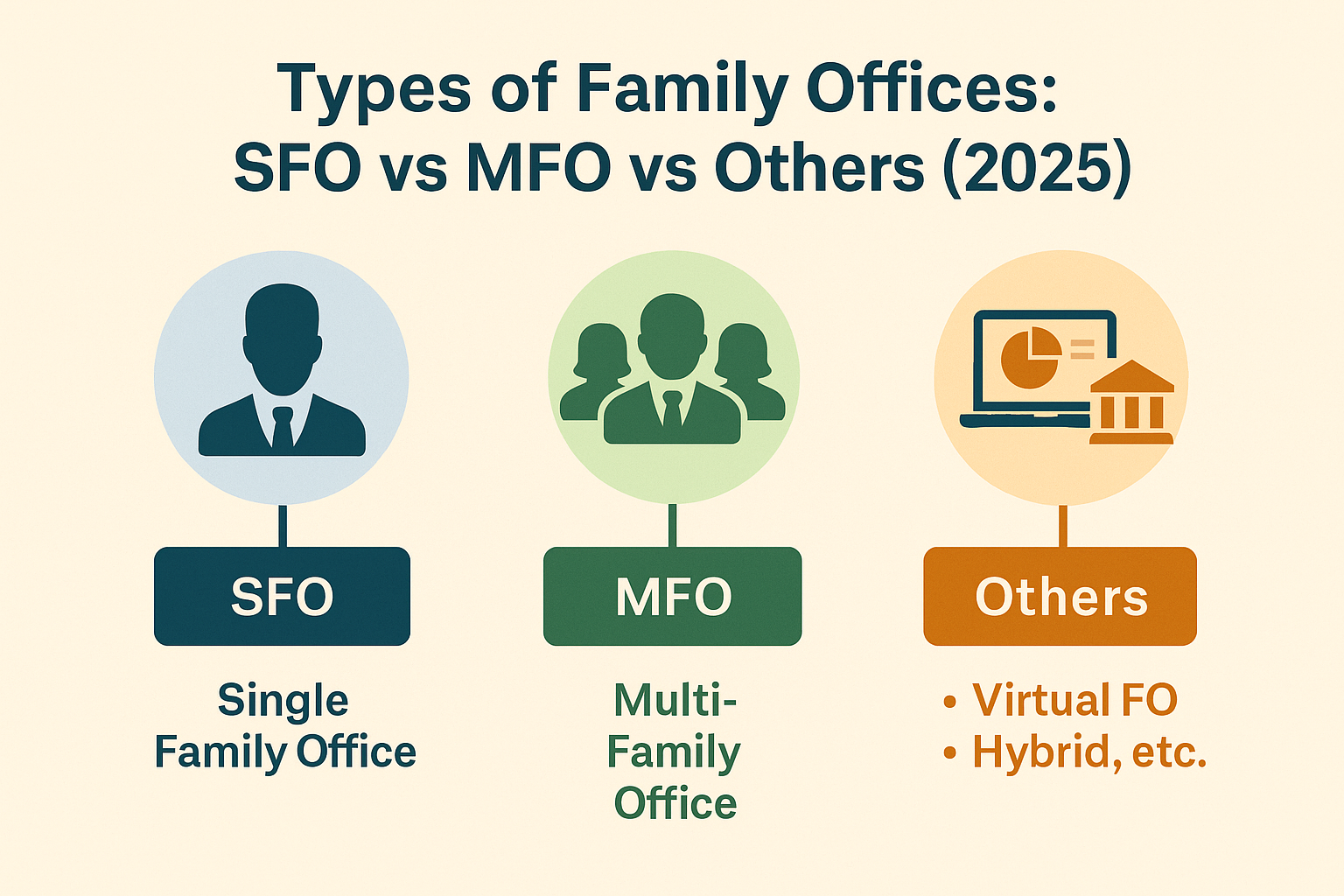

Types of Family Offices

Family offices come in several models depending on a family’s size, complexity, assets, and control preferences. Malaysia’s current incentive scheme focuses primarily on the Single Family Office (SFO), but the broader region sees multiple operational models.

- Single Family Office (SFO): Dedicated to the wealth and personal affairs of one family, offering full confidentiality and bespoke services. Malaysia’s current incentive scheme supports SFOs under the SFOV1 category.

- Multi-Family Office (MFO): Serves multiple families with cost-sharing benefits and access to broader expertise. Suitable for families that do not require a standalone office.

- Virtual Family Office (VFO): Digital-first operations leveraging outsourced specialists, ideal for globally mobile families seeking lower overhead.

- Embedded Family Office (EFO): Integrated within a family-owned business, unifying business strategy with long-term wealth preservation.

- Hybrid Models: Combine SFO, MFO, and VFO characteristics depending on governance, cost, and control requirements.

Top Asia Family Offices in the Global Top 100

Asia's wealth landscape continues to scale rapidly, and several regional family offices now appear in global top 100 rankings. These offices represent institutional-grade structures built around multi-generational wealth.

| World Rank | Family Office | Country / Region | Owner / Notable Figure |

|---|---|---|---|

| 19 | Hartono Family Office | Indonesia | Hartono Family |

| 21 | Indorama Capital Holdings | Asia | Aloke Lohia |

| 26 | Yoovidhya Family Office | Thailand | Yoovidhya Family (Red Bull) |

| 33 | PremjiInvest | India | Azim Premji |

| 37 | Sunrise Capital Management | Asia | Not publicly disclosed |

| 62 | AT Capital Group | Singapore | Arvind Tiku |

| 81 | Wah Hin & Company | Singapore | Tan Family |

| 84 | Yamauchi No. 10 | Japan | Yamauchi Family (Nintendo) |

| 95 | Catamaran Ventures | India | NR Narayana Murthy |

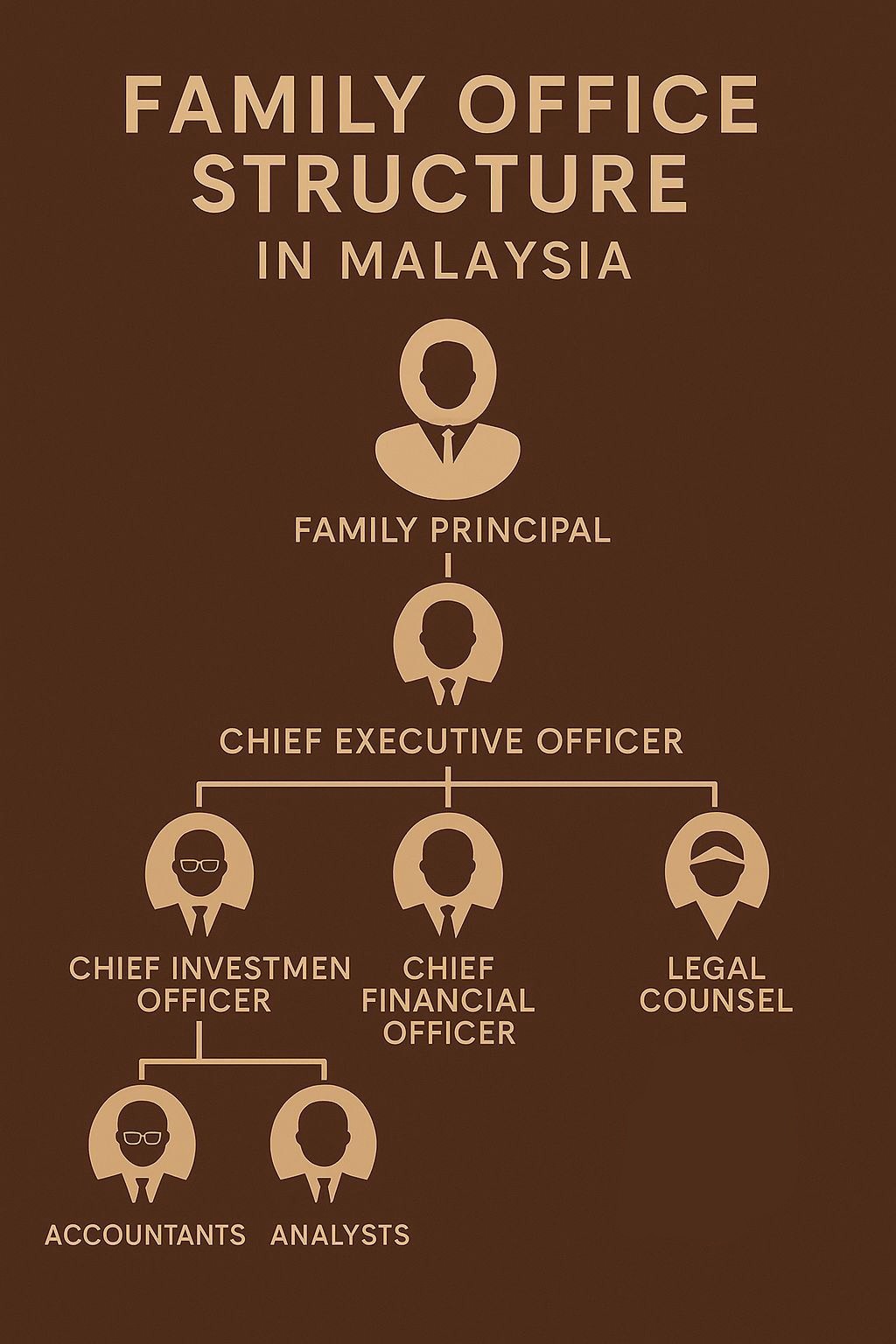

Family Office Structure in Malaysia

Malaysian family offices are now aligning with global best practices thanks to the newly launched Forest City Special Financial Zone (SFZ) framework. Structures are designed to combine investment control, governance, tax efficiency, and long-term succession planning.

Key Roles & Hierarchy

- Family Principal: Sets mission, risk appetite, and long-term direction.

- Chief Executive Officer (CEO): Leads operations and coordinates teams.

- Chief Investment Officer (CIO): Oversees investment allocation and risk.

- Chief Financial Officer (CFO): Handles tax, compliance, and financial controls.

- Legal Counsel: Manages trust structures, regulatory compliance, and estate matters.

- Accountants & Analysts: Support reporting, budgeting, and investment tracking.

Malaysian family office teams can range from lean 2–4 person setups to full global teams depending on wealth complexity.

Comparison: Family Offices in Malaysia, Singapore & Hong Kong

Malaysia’s new 0% tax incentive in the Forest City SFZ puts it on the map as a rising family office hub, but the ecosystem still trails Singapore and Hong Kong in maturity, talent depth, and liquidity.

- A new and untested regulatory framework

- A limited talent pool in governance, trusts, and cross-border planning

- A smaller capital market compared to other hubs

The table below provides a regional comparison:

| Feature | Singapore | Hong Kong | Malaysia |

|---|---|---|---|

| Legal Entities | Pte Ltd, Trust, VCC | LLC, Trust | Sdn Bhd, Trust, Labuan entities |

| Regulator | MAS, ACRA | SFC | SC, SSM, Labuan FSA |

| Tax Incentives | 13O / 13U exemptions | Proposed concessions | 0% tax for SFOV1 in SFZ |

| Market Size | 1,100+ family offices | ~200 family offices | First SFOs launched 2025 |

| Preferred Structures | Holding + fund + FO | Investment vehicles | SFO / SFOV |

| Licensing | SFO exemptions | Licensing required | Registration; exemptions apply |

| Investment Vehicles | VCC, Trusts | LLCs, Trusts | Sdn Bhd, Labuan Foundations |

| Competitiveness | Global leader | Regional powerhouse | Rapidly emerging |

FAQs

What is a Family Office (FO)?

A Family Office is a private wealth management advisory firm that provides a total outsourced solution for managing the financial, investment, and personal affairs of an ultra-high-net-worth individual or family.

What are the main types of Family Offices?

The main types are **Single Family Office (SFO)**, which manages wealth for one family (currently offered under the government incentive scheme), and **Multi-Family Office (MFO)**, which serves multiple families, often providing cost-sharing benefits.

What is the major incentive offered by the Malaysian government to attract Family Offices?

The government introduced the **Family Office Incentive Scheme** under the **Forest City Special Financial Zone (SFZ)**, which offers a **0% tax rate** for up to 20 years to eligible **Single Family Office Vehicles (SFOV1)**.

What is the minimum Asset Under Management (AUM) required to establish a Family Office in Malaysia?

Malaysia offers an accessible entry point through the **Labuan International Business and Financial Centre (Labuan IBFC)**, lowering the requirement to just **RM10 million** in Assets Under Management (AUM). Note that the Forest City SFZ incentive requires a minimum of RM30 million AUM.

What are the key eligibility requirements for the Forest City SFZ incentive scheme?

Key requirements for the SFOV1 include a minimum of **RM30 million** in managed assets, a minimum annual operational spending of **RM500,000** in Malaysia, and at least **10% of the AUM** or **RM10 million** must be invested locally.

What is the growth outlook for the Family Office sector in Malaysia?

The sector is accelerating rapidly. The Securities Commission (SC) is targeting a fivefold jump to **RM2 billion** in SFO AUM by **2026**, up from RM400 million in 2025.

Can a Family Office in Malaysia manage digital assets?

Yes. Modern Family Offices are tailored to manage new forms of wealth. Malaysia's regulatory openness allows FOs to securely manage emerging assets such as **crypto holdings, NFTs, tokenised assets, and digital art**.

How does Malaysia compare to established wealth hubs like Singapore and Hong Kong?

While Singapore and Hong Kong are mature hubs, Malaysia is rapidly improving its competitiveness with the 0% tax incentive in the SFZ and a lower AUM threshold (RM10 million via Labuan), positioning it as a competitive, cost-effective option.

Conclusion

Malaysia’s family office framework is now officially active, and the first SFOs have already gone live. Early adopters—both families and professionals—stand to benefit the most as regulations, talent, and ecosystem support continue to develop.

As the saying goes: the early bird catches the worm. Those who understand family offices now will be best positioned before the next wave of adoption arrives.

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning