Capital Gains Tax Malaysia: Trusts & Family Office Insights

Malaysia introduced Capital Gains Tax (CGT) in 2024. Disposals of unlisted Malaysian shares by companies, LLPs, co-ops and trust bodies, plus foreign capital gains remitted to Malaysia, are now in scope. For family offices and trusts, this matters: many hold assets in those vehicles. Structure, timing, and the 10%-on-net vs 2%-on-gross election (for pre-2024 shares) can shape succession, relocations and remittances

1. Overview of the 2024 Capital Gains Tax

Understanding Malaysia’s Capital Gains Tax

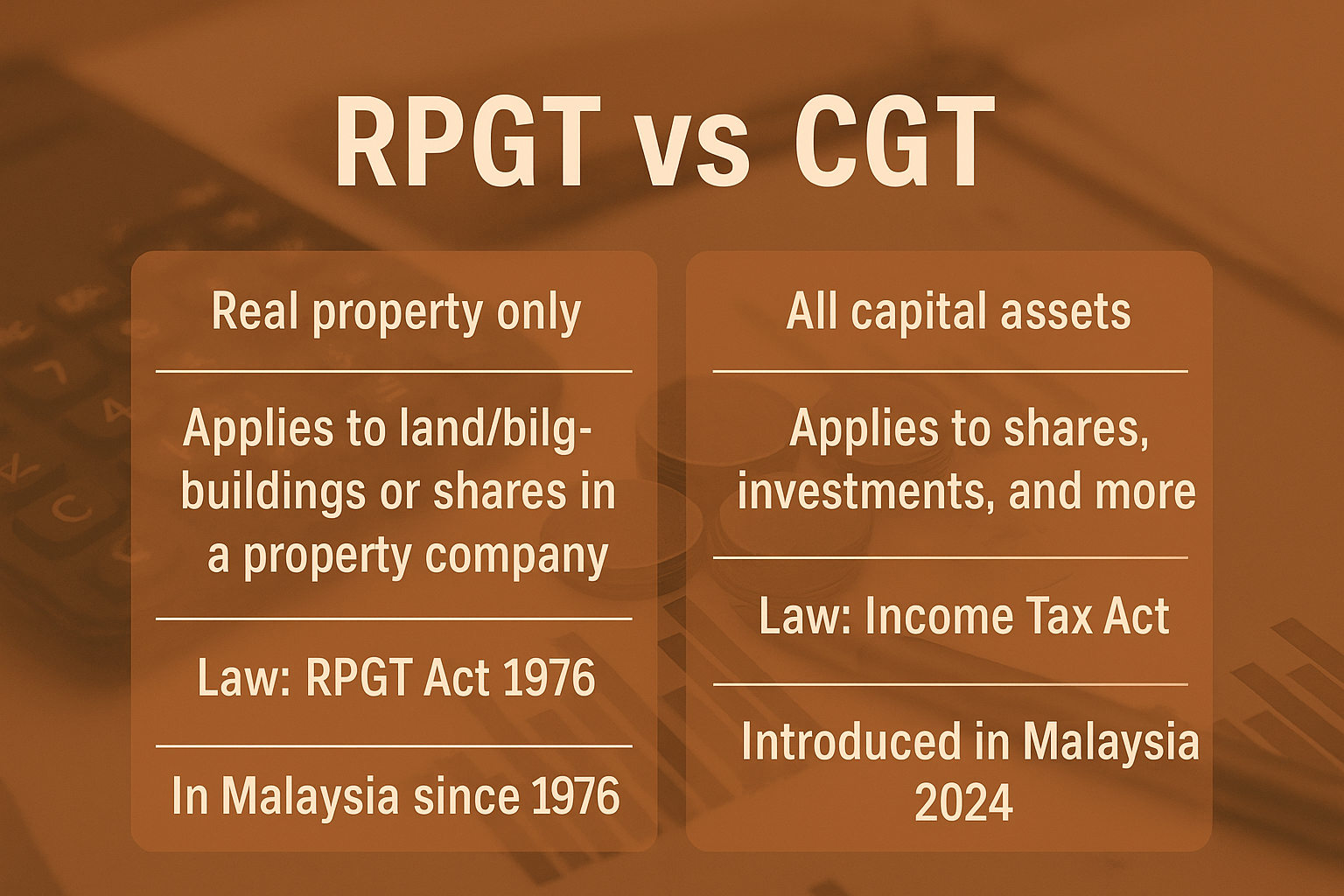

Until 2024, Malaysia taxed asset sales only under RPGT, leaving most other gains—like private company shares—tax-free. The new Capital Gains Tax (CGT) changes that, taxing profits from certain disposals by specified taxpayers

The core idea is to tax the “gain,” not the entire sale price. Imagine your company, a KL-based investment firm, buys unlisted shares in a Penang tech startup for RM100,000 and later sells them for RM150,000. The CGT applies only to the RM50,000 profit, not the full RM150,000 you received.

To give you a quick overview, here’s a simple breakdown of the new CGT framework.

Malaysia’s CGT At a Glance

The introduction of CGT marks a significant change, but its scope is quite specific. The table below summarises the key features you need to know.

| Key Feature | Description |

|---|---|

| Effective Date | 1 January 2024 |

| Who It Affects | Primarily companies, LLPs, trust bodies, and co-operatives. |

| What Is Taxed | Gains from selling unlisted Malaysian company shares and foreign capital assets (if the gains are received in Malaysia). |

| Key Exemption | Individuals are generally exempt from this CGT on the disposal of shares. |

| Non-Taxable Assets | Shares of companies listed on Bursa Malaysia remain exempt from CGT. |

This summary captures the essence of the new tax, highlighting its targeted nature and distinguishing it from broader capital gains taxes seen in other countries.

Who Is Primarily Affected?

The capital gains tax in Malaysia for 2024 isn’t a blanket tax on everyone. Its focus is quite narrow, targeting specific entities rather than the general public.

The main groups on the hook for this tax are:

- Companies (both Sdn Bhd and Bhd)

- Limited Liability Partnerships (LLPs)

- Trust bodies

- Co-operative societies

Here’s the most important takeaway for many: individuals are generally exempt from this new CGT when selling their shares. So, if you’re a personal investor offloading some shares, these specific rules likely won’t impact you. The tax is designed to apply to corporate-level transactions.

What Assets Are Covered?

The new CGT zeroes in on gains from the disposal of two main types of assets:

- Unlisted Shares: This means shares in a company that is incorporated in Malaysia but isn’t listed for public trading on the Bursa Malaysia stock exchange.

- Foreign Capital Assets: If you sell assets located outside Malaysia and bring the profits back into the country, those gains can also be subject to tax.

This distinction is crucial. It makes it clear that your profits from selling shares of a public-listed company on Bursa Malaysia are still exempt.

Local vs. Foreign Assets

The new CGT’s reach doesn’t just stop at the type of entity; it also looks at where the assets are located. The rules make a clear distinction between gains made from Malaysian assets and those from foreign sources.

For assets within Malaysia, the tax primarily kicks in on the disposal of unlisted shares in a company incorporated here. This will be the most common scenario triggering CGT for Malaysian businesses.

But that’s not all. The rules also extend to foreign-sourced income (FSI). This means if a Malaysian-based company sells an asset located overseas—like shares in a foreign subsidiary or an office building in London—and brings that profit back home, those gains could be taxed.

Real Property Gains Tax vs Capital Gains Tax – Quick guide to Malaysia’s asset taxes

2. Key Rates & Exemptions

How to Calculate Your CGT Liability

Under Malaysia’s new CGT rules, companies, LLPs, and trust bodies with unlisted shares or foreign assets are taxed on their net chargeable gain:

- Disposal Price − Acquisition Cost − Incidental Costs = Net Chargeable Gain

- Disposal Price: Total amount or value you get from selling the asset.

- Acquisition Cost: What you originally paid for it.

- Incidental Costs: Direct expenses like legal fees, stamp duty, valuation fees, and commissions.

Keeping accurate records of these figures is key, as they directly reduce your taxable gain.

Tax Rates

Standard rate: 10% on the net chargeable gain (for shares acquired on/after 1 March 2024).

Transitional option: For assets owned before CGT began, you can choose between:

- 10% on the net gain, or

- 2% on the gross sale value.

Your choice can significantly affect your tax bill—pick the method that works best for your profit margin.

Key Takeaway: For assets bought before the CGT era, you have a choice. A high-profit-margin sale will likely benefit from the 2% gross option, while a low-margin sale may be better off with the 10% net gain option.

CGT Calculation Example for Pre-Acquired Shares

Let’s put this into a real-world context to see how the numbers play out. Imagine a Malaysian company, ABC Sdn Bhd, sells its entire stake in an unlisted local tech startup.

Here are the details:

- Acquisition Date: 10 June 2018

- Original Purchase Price (Acquisition Cost): RM 1,000,000

- Incidental Costs (Legal & Admin): RM 50,000

- Sale Date: 15 May 2024

- Gross Sale Price (Disposal Value): RM 4,000,000

Since ABC Sdn Bhd bought the shares long before 1 Jan 2024, they get to choose between the two tax calculation methods. Let’s compare them side-by-side.

| Metric | Option 1 (10% on Net Gain) | Option 2 (2% on Gross Value) |

|---|---|---|

| Gross Sale Price | RM 4,000,000 | RM 4,000,000 |

| Less Acquisition Cost | (RM 1,000,000) | Not Applicable |

| Less Incidental Costs | (RM 50,000) | Not Applicable |

| Net Chargeable Gain | RM 2,950,000 | Not Applicable |

| Tax Rate Applied | 10% | 2% |

| Final Tax Payable | RM 295,000 | RM 80,000 |

In this scenario, the profit margin is huge. The net gain is a hefty RM 2.95 million.

By choosing Option 2 and paying 2% on the gross sale price, ABC Sdn Bhd’s tax bill is only RM 80,000. That’s a massive saving of RM 215,000 compared to the standard 10% net gain method.

This example makes it crystal clear: finance teams absolutely must run both calculations for every eligible transaction. Making the right choice here can have a major impact on the bottom line.

3. Why CGT Matters for Family Offices & Trusts

The introduction of Capital Gains Tax (CGT) in Malaysia marks a major shift for family offices and trusts. Many of these structures hold assets through private companies, trusts, or special-purpose vehicles — all of which may now fall within the CGT net. Even when the underlying goal is long-term wealth preservation, a poorly timed sale or transfer could result in a sizeable tax bill.

For family offices managing multi-generational wealth, CGT affects more than just one transaction — it influences investment decisions, exit strategies, and cash flow planning. Trusts, in particular, must pay close attention to how gains are calculated, as only the profit (not the full sale value) is taxed. The right approach can mean the difference between keeping more wealth within the family or losing it to avoidable taxes.

4. Strategic Considerations for Family Offices & Trusts

To navigate CGT effectively, family offices and trusts need more than just compliance — they need strategy. This can include:

Structuring asset ownership so gains are realised in the most tax-efficient way.

Timing disposals to align with exemptions or favourable market conditions.

Using approved reorganisations to transfer assets without triggering CGT.

Reviewing cross-border holdings to understand how foreign gains and remittances will be taxed.

Coordinating with legal and tax advisors to ensure trusts, holding companies, and family members are all aligned.

By treating CGT as a key part of overall wealth strategy, family offices and trusts can not only protect assets but also strengthen their position for future growth and succession.

5. Practical Scenarios

To understand how Malaysia’s 2024 Capital Gains Tax works in practice, let’s look at three common situations

Scenario 1 – Selling Local Company Shares

Background:

Maju Jaya Sdn Bhd, a trading company in Penang, holds shares in a non-listed Malaysian startup.

Transaction:

On 10 May 2024, Maju Jaya sells its shares and makes a profit. This triggers Malaysia’s Capital Gains Tax (CGT) rules for unlisted shares.

Filing Deadline:

The 60-day clock starts from the date of disposal, so the CGT return and payment must be submitted by 9 July 2024.

Action:

Gather all agreements, expense receipts, and CGT calculations, then file the e-CKM form via MyTax.

If the shares were acquired before 1 Jan 2024, calculate both 10% on net gain and 2% on gross sale price to see which is lower.

If acquired on/after 1 Jan 2024, apply 10% on net gain.

Outcome:

CGT at 10% applies on the gain (sale price minus cost and allowable expenses). Staying organised avoids penalties and interest.

Scenario 2 – Selling Overseas Investment and Remitting Funds

Background:

Tech Innovations Sdn Bhd, based in Kuala Lumpur, bought a stake in a UK software startup several years ago.

Transaction:

In 2024, the company sells its entire stake, making a substantial profit.

Remittance to Malaysia:

The proceeds are transferred into its Malaysian corporate bank account to fund expansion plans.

Action:

Before remitting, assess the tax impact. Profits from foreign assets remitted into Malaysia are generally taxed at the prevailing corporate income tax rate (currently up to 24%) rather than the 10% CGT rate—unless the company qualifies for the temporary 2024–2026 economic substance exemption.

Outcome:

Without the exemption, the remitted gain is subject to normal corporate tax, which could be significantly higher than CGT

Scenario 3 – Passing Shares to the Next Generation

Background:

A family trust holds shares in a Malaysian private company as part of a long-term wealth plan.

Transaction:

The trustee transfers these shares to the next generation during a business reorganisation.

Structure:

The transfer is done under an approved reorganisation recognised by the tax authorities.

Action:

Plan the transfer under exemption rules to avoid triggering CGT, with proper documentation and timing.

Outcome:

If the exemption applies, no CGT is payable, preserving more value for beneficiaries and enabling a smooth succession.

Frequently Asked Questions About CGT in Malaysia

When new tax rules appear, confusion often follows. Malaysia’s 2024 capital gains tax is no exception. Here are clear answers to common questions—no legal jargon, just what it means for you and your business

1. Does CGT Apply If I Sell My Shares On Bursa Malaysia?

No, it doesn’t. This is a crucial point to remember: the new CGT framework is specifically designed to target the sale of unlisted shares in Malaysian companies.

If you make a profit from selling shares publicly traded on Bursa Malaysia, those gains are still exempt from this tax. This applies to everyone, from individual retail investors to large corporations, ensuring the public stock market remains an attractive place to invest without this extra layer of tax.

2. What If My Company Acquired Shares Years Before This Tax Existed?

The government anticipated this exact scenario and put a transitional rule in place. If your company held unlisted shares acquired before 1 January 2024, you get to make a strategic choice when you decide to sell them.

You can pick one of two ways to calculate the tax:

- Option 1: Pay a 10% tax on the net chargeable gain. This is your actual profit after you subtract the original purchase price and any related costs.

- Option 2: Choose to pay a flat 2% tax on the gross sale price, which is the total amount you sold the shares for, without any deductions.

This flexibility lets you pick the more financially sensible route depending on how much profit the sale actually generated.

3. Does This Tax Affect Foreign Companies?

Yes, it does. The seller’s location doesn’t matter. When a foreign-registered company sells its shares in a Malaysian-incorporated company, any gain from that sale falls under Malaysia’s CGT.

The deciding factor isn’t where the shareholder is based, but where the company whose shares are being sold is incorporated. If the asset is “Malaysian shares,” the tax applies.

This approach creates a level playing field, making sure that both local and foreign sellers of Malaysian assets are treated the same under the new law.

4. How Is Foreign-Sourced Income Treated?

Generally, capital gains earned from foreign sources and brought back into Malaysia are taxable. However, there’s a pretty significant temporary exemption you should know about. While these remitted gains would typically be taxed at standard income tax rates, the government is offering a temporary pass.

According to insights from PwC on special CGT rules, an exemption is available for gains brought into the country between 1 January 2024 and 31 December 2026. To qualify, your company needs to demonstrate it has real economic substance here in Malaysia.

5. Can family offices benefit from incentive schemes to mitigate CGT?

Potentially—but not automatically. The Forest City Single Family Office (SFO) incentive offers 0% income tax on qualifying investment income and 15% for certain employees, but CGT still applies unless the transaction falls under a separate gazetted exemption (such as an approved restructuring or IPO-related disposal). Family offices should seek professional advice to align their structure and transactions with both the SFO rules and Malaysia’s CGT provisions.

Navigating capital gains and estate planning is complex. FIAM connects families and business owners with experienced professionals who can help design strategies for wealth preservation and succession. We share insights, resources, and trusted contacts so you can make informed decisions. Click on the button below for consultation

Disclaimer: The information on this site is general in nature and not legal, tax, or financial advice. Laws change and individual circumstances differ—seek professional advice; FIAM and the author are not liable for actions taken based on this content

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning