How To Set Up an Offshore Trust in Malaysia

Key Takeaways

- Why people do it: diversify from MYR, protect assets, and plan succession across borders.

- Adoption: notable Malaysians have used offshore structures (see table) to manage and protect wealth.

- Two ways to set up: Step 4A (Agency) is streamlined and ends at activation; Step 4B (Independent) continues through Steps 5–8 for full control.

An offshore trust places assets under a licensed trustee for your beneficiaries, guided by a trust deed and a letter of wishes—aiming for protection, diversification, and smoother succession.

In recent times, amid fluctuations in the Malaysian Ringgit (MYR) and shifts in the global financial landscape, offshore trust have emerged as a compelling option for Malaysian investors seeking to diversify their wealth and safeguard assets. The MYR has experienced significant depreciation, potentially causing assets denominated in MYR to drop by as much as 32.11% in the last 10 years.

MYR Context

| Year | Exchange Rate (Average: 1 USD to MYR) | Percentage Change |

|---|---|---|

| 2014 | 3.27 MYR | – |

| 2025 | 4.32 MYR | 32.11% |

Asset Protection

In Malaysia, asset protection isn’t limited to business owners—professionals such as doctors, lawyers, and consultants also face high-value claims. A 2024 case in Penang saw several doctors nearly having their assets seized in a RM45 million lawsuit, highlighting the risk of personal exposure. Offshore or Labuan trusts are commonly used to ring-fence personal wealth from such liabilities while keeping ownership transparent and lawful.

Cross-Border Succession

For families with assets or beneficiaries overseas, offshore trusts simplify inheritance across jurisdictions. The recent Wahaha case in Hong Kong shows how cross-border succession can fail without clear structures or professional advice.

Reported Malaysian Use of Offshore Structures

Notable figures in Malaysia have also embraced offshore trusts for their potential advantages. This comprehensive guide explores the process of establishing an offshore trust in Malaysia, taking into account the depreciation of the MYR, and highlights how prominent Malaysians have utilised offshore trusts to optimise tax efficiency and safeguard their assets.

| Individual / Position | Offshore Connection / Pandora Papers Summary |

|---|---|

| Daim Zainuddin Former Finance Minister |

Linked to multiple BVI companies and trusts worth about £25 million (RM141 million), with family members listed as owners. |

| Zafrul Aziz Former Finance Minister |

Former director of Capital Investment Bank (Labuan) Ltd; stated he left the role over a decade ago and sought legal clarification. |

| Ahmad Zahid Hamidi UMNO President |

Director of BVI firm Breedon Limited (1996); claims inactivity and denies tax-evasion intent. |

| Yamani Hafez Musa Former Deputy Finance Minister |

Director of Great Ocean Consultants (BVI) with siblings; company later sold in 2016. |

| G Gnanalingam Cargo Company Owner |

Owned BVI firm Paisley Marketing Ltd (later dissolved); ranked among Malaysia’s wealthiest. |

| William Leong Former Party Treasurer |

Linked to Jersey’s Collister Holdings Ltd and BVI’s Maxcorp (Asia) Overseas Ltd during earlier corporate roles. |

| Mahmud Abu Bekir Son of Sarawak Governor |

Director of family-owned BVI firm Rondinmass Inc., holding commercial properties in Seattle and Washington. |

| Tiong Hiew King Timber Company Founder |

Owner of Cook Islands-registered IB Holdings Ltd engaged in investments and timber trade. |

| Larry Low Hock Ping Parent of Jho Low |

Connected to BVI entities Coswell Corporation and Strategic Equities Ltd (approx. US$7 million in shares). |

| Lim Kok Thay Genting Group Chairman |

Linked to BVI company Azure Supreme Ltd; business nature undisclosed. |

Source: Coconuts (2021-10-06) . Listing is descriptive, not an endorsement.

Step 1: Understand Offshore Trusts

An offshore trust is established in a jurisdiction outside Malaysia, usually with favourable regulation and tax treatment. Typical purposes: wealth preservation, succession planning, and confidentiality.

Step 2: Choose a Jurisdiction (quick reference)

Where Malaysians Set Up Trusts

- Singapore — stable, common law, modern trust legislation incl. reserved investment powers; strong banking; can hold Malaysian & global assets via holding structures.

- Labuan (Malaysia) — onshore legitimacy with offshore benefits; Labuan Special Trust (LST) can hold a Labuan company that owns assets; tax at 3% of audited net profits; distributions to beneficiaries tax-exempt; Malaysian property needs Labuan FSA approval.

- International centres — Hong Kong (modernised regime; forced-heirship protection; perpetual trusts), Guernsey (no inheritance/wealth/gift/CGT; many non-resident trusts exempt on non-Guernsey income), Gibraltar (non-resident beneficiary trusts untaxed on non-Gibraltar income; firewall laws).

A trust’s residence generally follows its trustee. Tax outcomes depend on the settlor, beneficiaries, and the trust itself.

Popular Offshore Destinations for Trust and Wealth Planning

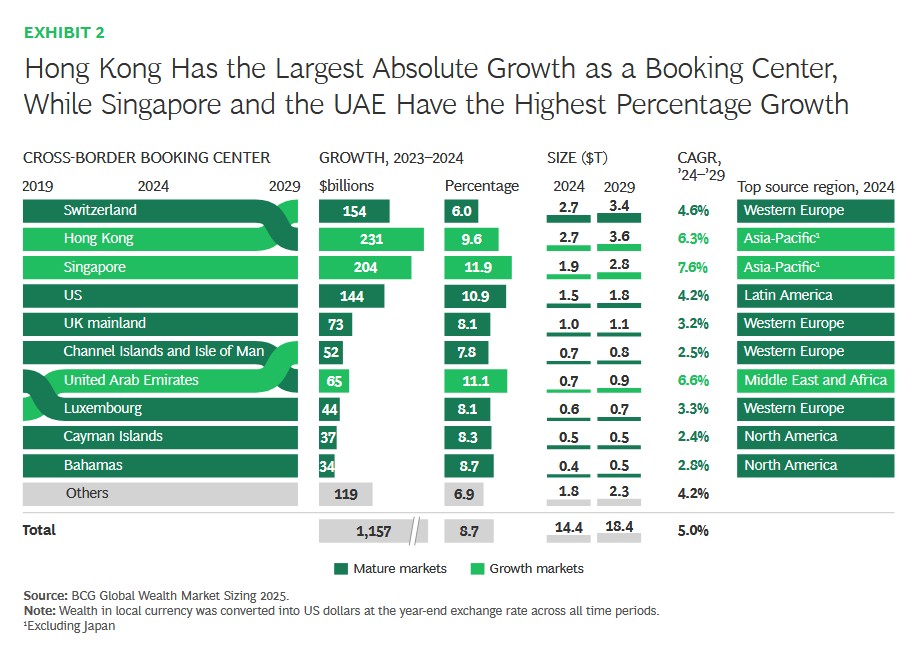

According to the BCG Global Wealth Market Sizing 2025 report, Hong Kong, Singapore, and the UAE have become the fastest-growing offshore wealth centers globally. While Switzerland remains the largest and most established hub, Asia-Pacific jurisdictions now dominate in growth — with Singapore leading at 7.6% CAGR through 2029.

Step 3: Engage Offshore Trust Professional Services in Malaysia

Given the complexity of establishing an offshore trust, engaging professional services is advisable. Reputable law firms, trust companies, or financial advisors specialising in offshore structuring can guide trust formation, compliance, and administration. There are limited offshore trust service providers in Malaysia.

Timeless International Family Office opened in Kuala Lumpur on 23 March 2024. Learn more at ti-fo.com. For complex needs, in-person meetings help clarify objectives and documents.

Recent activity: Malaysiakini announcement.

Learn via Monthly FIAM Events

FIAM hosts regular in-person sessions on offshore trusts and cross-border structuring. Check the latest dates here: Family Office, Trust & Estate Planning Seminars (Malaysia).

Local trusts (e.g., Rockwills, UBB Amanah) may differ from offshore trusts in several aspects; offshore options can offer additional flexibility. We’ll explore this in future posts—join our newsletter for updates.

Join our newsletter

Step 4A: Agency Route (Option 1)

StreamlinedStep 4: Engage the Offshore Trust Agency in Malaysia

Fill out forms and provide required information. The agency prepares documents from your inputs. You’ll open your offshore trust account system, verify details, and confirm payment. A quick follow-up call keeps processing on track. Legal experts draft the trust deed (terms, objectives, beneficiaries). You may also apply for a credit card linked to the trust account. Once paperwork is signed and submitted, your offshore trust account is activated.

You are done.

Step 4B: Setting Up Independently (Option 2)

More control, more stepsStep 4: Draft the Trust Deed

Work closely with a qualified trust/estate lawyer. Make the deed clear, comprehensive, and tailored to your family and assets.

- Define beneficiaries (classes and future heirs).

- Set trust powers (investment, distributions, replacement of trustee).

- Add asset-protection provisions and succession mechanics.

- Consider a Protector role (consent/oversight).

- State governing law, perpetuity/vesting, and dispute resolution.

Tip: Use a non-binding Letter of Wishes to guide distributions without amending the deed.

Step 5: Select Trustee(s) & Confirm Settlor

The trustee is a fiduciary. Choose one with governance strength, responsiveness, and solid compliance.

- Trustee: licensing, solvency, track record, fee schedule, reporting cadence.

- Settlor: document Source of Wealth / Source of Funds.

- Consider co-trustees or a corporate trustee for continuity.

Step 6: Fund the Offshore Trust

Retitle assets to the trustee (or an underlying company) per the deed and local rules.

- Cash & securities: bank/broker transfers with compliance packs.

- Private shares: update cap table, share transfer forms, valuations.

- Real estate: conveyance steps, filings, and any stamps/fees.

- Maintain a complete paper trail for every transfer.

Compliance: observe exchange controls, tax filings, and required notifications in all relevant jurisdictions.

Step 7: Compliance & Reporting

- KYC/AML: ongoing verification and screening by the trustee.

- CRS/FATCA: determine reporting status and file where applicable.

- Tax: obtain advice for settlor/beneficiaries; manage returns/withholding.

- Records: minutes, statements, valuations, distribution notes.

Step 8: Monitor & Review

- Annual trustee meeting and performance review.

- Reassess asset allocation and banking platforms.

- Update the Letter of Wishes as circumstances change.

- Consider deed variations where permitted and advised.

Is an Offshore Trust from Malaysia the Right Move?

Setting up an offshore trust in Malaysia offers numerous advantages, including asset protection, tax optimisation, and enhanced privacy — embodying the principles of Dark Forest Logic . By following these steps and seeking professional guidance, Malaysian investors can establish a robust offshore trust structure to safeguard their wealth and achieve their long-term financial objectives.

FAQs

Why do Malaysians set up trusts?

Short answer: protection, cross-border succession, currency diversification, privacy, and efficient administration where lawful.

Common objectives include protecting family assets from business risks, planning inter-generational transfers across jurisdictions, diversifying out of MYR exposure, maintaining privacy, and—where lawful—administering income and gains efficiently inside a trust framework.

Where is the best place to set one up?

Short answer: often Singapore or Labuan; also consider Hong Kong, Guernsey, and Gibraltar depending on goals and banking access.

Singapore offers stability, a familiar common-law system, modern trust legislation (incl. reserved powers), and deep banking. Labuan (Malaysia) combines onshore legitimacy with offshore features—e.g., the Labuan Special Trust (LST), 3% tax on audited net profits, and tax-exempt beneficiary distributions (Malaysian property requires Labuan FSA approval). For specific structuring needs, families also evaluate Hong Kong (modernised regime; forced-heirship protection), Guernsey (no inheritance/wealth/gift/CGT; many non-resident trusts exempt on non-Guernsey income), and Gibraltar (non-resident beneficiary trusts not taxed on non-Gibraltar income; firewall laws).

Why use a trust to hold an offshore company?

Short answer: separates control and benefit, improves continuity, and suits banking/operations while the trust oversees the company.

A common structure is a trust that owns 100% of the shares of an offshore company, and the company then holds bank/brokerage accounts or other assets. Families choose this for:

- Separation of control & benefit: Trustee/shareholder and company directors manage; beneficiaries receive distributions.

- Continuity: On death/incapacity there is no probate over company shares; trusteeship continues seamlessly.

- Asset protection: Properly drafted trusts (independent trustee, sound governance) can ring-fence assets from personal/business risks.

- Succession planning: Distributions guided by the deed and a Letter of Wishes across generations and jurisdictions.

- Banking practicality: Many banks prefer operating via a company, with the trust providing shareholder-level oversight.

- Governance flexibility: Protector role, reserved powers (where appropriate), and board composition to tailor control.

Considerations: Watch management & control/substance, CFC/attribution rules, CRS/FATCA reporting, and the impact of any reserved powers. Obtain jurisdiction-specific legal/tax advice.

When Do You Need an Offshore Trust to Protect Your Assets?

Short answer: when you have multi-jurisdiction assets, higher liability exposure, or succession needs requiring formal governance and continuity.

Consider a trust when you need structure and continuity beyond simple account titling—typically if you:

- Own significant assets across multiple countries or currencies.

- Face business or professional liability risks and want separation from personal assets.

- Need inter-generational succession without probate delays across jurisdictions.

- Support vulnerable beneficiaries (minors, special needs) or blended families.

- Require formal governance (trustee, protector, letter of wishes) rather than informal arrangements.

Note: Proper legal drafting, independent trusteeship, and ongoing compliance are essential. A trust is not a vehicle for tax evasion or avoiding lawful creditor claims.

What’s the Most Cost-Effective Way to Set Up an Offshore Trust?

Short answer: a standard discretionary trust in a mainstream jurisdiction via an agency-assisted setup with a simple asset mix.

The lowest all-in cost usually comes from a standard discretionary trust in a mainstream jurisdiction, using an agency-assisted setup with a licensed trustee and a simple asset mix (cash/securities)—no complex companies or real estate at the start.

- Keep the structure simple: one trust, one underlying company (only if needed), one banking relationship.

- Choose common jurisdictions: mature centres often have competitive trustee fees and clearer processes.

- Limit bespoke features: custom powers, multiple protectors, or committees increase drafting and annual costs.

- Bundle services: some providers offer fixed-fee onboarding for deed, KYC, and account opening.

Reality check: “Cheapest” should not compromise governance or compliance. Compare setup fees, annual trustee fees, account/brokerage fees, and any company maintenance if used. Get written quotes before committing.

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning

Related Insights

Forest City SFO vs Labuan Trust vs Offshore Trust (2026)

Compare Forest City SFO (0% tax), Labuan trusts and offshore trusts. See AUM, substance, costs, layering strategies and best fit for Malaysians in 2026.

Family Office in Malaysia: 6 Major Reasons You Must Know Now

Family Office in Malaysia: Why You Must Know This Now (2026 Outlook) Last updated: 19 Feb 2026 Family Office Malaysia Forest City SFZ Family Office Incentive Scheme

Estate Planning in Malaysia: Will vs Trust vs Family Office

Importance of Estate Planning in Malaysia (2026): Will vs Trust vs Family Office Estate Planning Malaysia Will (Wasiat) Privat

The Truth About Labuan Family Offices: Is It Really an SFO?

Setup a Labuan Family Office in 2026. Compare Private Fund vs Waqf structures, understand requirements, and see the new FSA fee revisions.