The Truth About Labuan Family Offices: Is It Really an SFO?

FIAM (Family Inheritance Association of Malaysia) presents the definitive 2026 analysis of the Labuan wealth landscape. This guide clarifies the "Private Fund" route, introduces the Islamic (Waqf) advantage, and lists the new 2026 operational fees.

FIAM Executive Summary: The 2026 Outlook

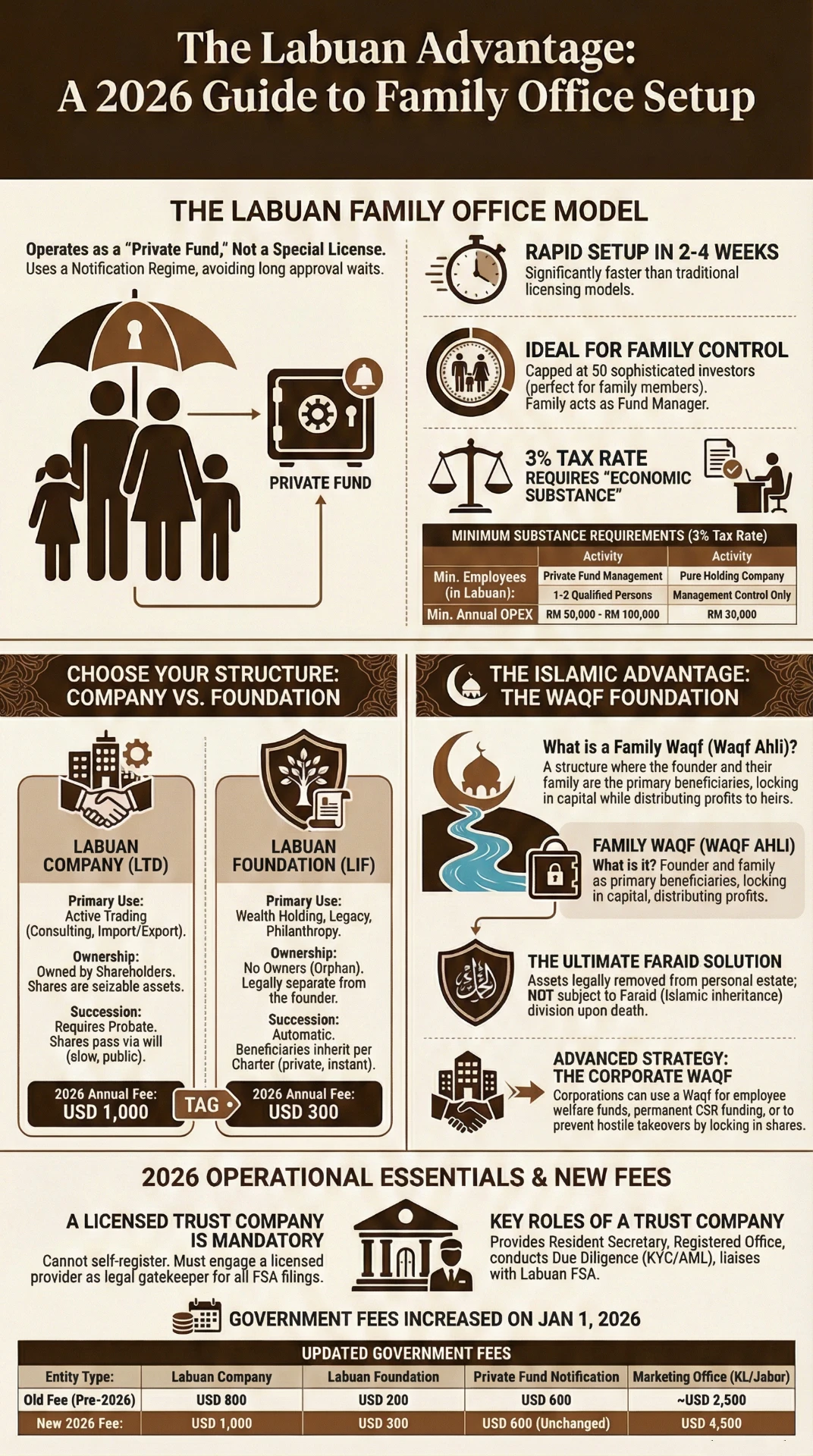

- The Structure (Lesen): There is no specific "SFO License" in Labuan. Labuan Family Offices operate as "Private Funds" (Notification Regime) for speed (2-4 weeks setup).

- The Hidden Gem: For Muslim families, Labuan offers the Waqf Foundation—a unique structure that Singapore lacks—allowing for Faraid-compliant legacy planning.

- The Cost Update: Labuan FSA fees have increased effective Jan 1, 2026. Foundations now cost USD 300/year; Companies USD 1,000/year.

1. Labuan Family Office Setup & Requirements

In 2026, the labuan family office setup does not utilize a complex licensing regime. Instead, families utilize the Private Fund (Mutual Fund) structure under the Labuan Financial Services and Securities Act 2010.

Why the "Private Fund" Route?

This is a "Notification" regime, meaning you do not need to wait months for approval. You simply notify the FSA through your trust company.

- Speed: Launch in 2-4 weeks.

- Investors: Capped at 50 sophisticated investors (perfect for family members).

- Control: The family can act as the Fund Manager (Self-Managed).

Comparison: Labuan vs. Forest City SFO

| Feature | Labuan Private Fund | Forest City SFO (SFZ) |

|---|---|---|

| Mechanism | Notification (Inform FSA) | Approval (Apply to SC) |

| Min. AUM | None (Solvency Only) | RM 30 Million |

| Timeframe | Fast (2-4 Weeks) | Slow (3-4 Months) |

| Tax Rate | 0% (Holding) or 3% (Trading) | 0% (Incentive Period) |

2026 Substance Requirements: The "Fit & Proper" Rule

To qualify for the 3% Tax Rate, a labuan family office must meet strict Economic Substance Requirements (ESR). In 2026, the definition of "Full-Time Employee" has tightened.

⚠️ New "Fit and Proper" Standard

Junior staff do not count. You cannot strictly hire a driver or receptionist to meet the requirement. The employee must perform "Core Income Generating Activities" (CIGA)—e.g., an Investment Manager, Compliance Officer, or Accountant.

| Activity | Min. Employees (Labuan) | Min. OPEX (Annual) |

|---|---|---|

| Private Fund Management | 1-2 Qualified Persons | RM 50,000 - RM 100,000 |

| Pure Holding Company | None (Management Control Only) | RM 20,000 |

2. Structure: Labuan Foundation vs Company

The most common question we receive is: "Should I open a company or a foundation?" The choice for labuan foundation vs company for family office depends on your primary objective: **active trading** vs **asset protection**.

| Feature | Labuan Company (LTD) | Labuan Foundation (LIF) |

|---|---|---|

| Ownership | Shareholders Shares are assets that can be seized or frozen. |

No Owners (Orphan) The entity owns itself. Assets are legally separated from the founder. |

| Succession | Probate Required Shares pass via Will/Probate (slow, public). |

Automatic Beneficiaries receive assets per the Charter (instant, private). |

| Primary Use | Active Trading (Import/Export, Consulting) | Wealth Holding, Legacy, Philanthropy |

| 2026 Annual Fee | USD 1,000 | USD 300 |

3. The "Hidden Gem": Labuan Foundation for Family Wealth

While Singapore dominates the conventional space, Labuan is the global leader for Islamic Wealth Management. A labuan foundation for family wealth can be registered as an International Waqf.

Family Waqf (Waqf Ahli)

Unlike a charitable waqf, this structure allows the founder and their family to remain the primary beneficiaries. It locks the capital (preventing spendthrift heirs from draining it) while distributing the profits.

Faraid Solution

Assets placed in a Labuan Waqf during the founder's lifetime are legally removed from the estate. They are not subject to Faraid division upon death, ensuring the business empire remains intact.

Advanced Strategy: Corporate Waqf

A Labuan Foundation isn't just for individuals. Corporations can establish a corporate waqf via labuan foundation to hold shares or profits for specific purposes:

- Employee Welfare Fund: Use company profits to fund a Waqf dedicated to scholarships or medical aid for employees' families.

- CSR Permanence: Lock a block of shares into a Waqf. The dividends perpetually fund your Corporate Social Responsibility (CSR) initiatives, tax-efficiently.

- Business Continuity: Prevent a hostile takeover by locking controlling shares in a Waqf that cannot be sold.

Figure 1: The FIAM 2026 Strategic Roadmap for Labuan Family Offices

4. The Role of the Labuan Trust Company

You cannot walk into the FSA and register a company yourself. Every family office must engage a licensed labuan trust company for family office administration.

They act as your legal "Gatekeeper" and provide:

- Resident Secretary: Mandatory officer required by law.

- Registered Office: The physical address for your entity.

- Due Diligence: Conducting KYC/AML checks on directors.

- FSA Liaison: Handling all official filings and fee payments.

How to Choose a Corporate Services Provider

Since your Trust Company holds your statutory registers, choosing the wrong corporate services provider labuan family office can lead to compliance failures.

1. License Verification

Ensure they hold a valid Trust Company License from Labuan FSA. "Marketing Agents" cannot sign your documents.

2. Private Fund Expertise

General secretaries may not understand the "Information Memorandum" or "Waqf Charter." Ask for their specific track record with Family Offices.

3. Bank Access

Top-tier providers have pre-vetted relationships with Labuan investment banks, speeding up your account opening.

5. 2026 Fee Revisions (Effective Jan 1)

FIAM Alert: Budgeting for 2026 must account for the revised Labuan FSA fee structure. The government has increased fees to reflect compliance costs.

| Entity Type | Old Fee (Pre-2026) | New 2026 Fee |

|---|---|---|

| Labuan Company | USD 800 | USD 1,000 |

| Labuan Foundation | USD 200 | USD 300 |

| Private Fund Notification | USD 600 | USD 600 (Unchanged) |

| Marketing Office (KL/Johor) | ~USD 2,500 | USD 4,500 |

*Note: These are government fees only. Professional fees charged by your Trust Company for secretarial and compliance services are separate.

📽️ Labuan Family Office Explained (Video)

Watch this concise overview to understand how a Labuan Family Office is structured and how it differs from other legacy planning tools. The video highlights key concepts that complement this written guide.

Note: This video is intended to reinforce key concepts in this guide, including the differences between Labuan family office frameworks, trusts, and conventional inheritance planning.

FAQ: Labuan Family Office

Does Labuan have a specific "SFO License"?

No. Labuan does not have a separate "Single Family Office" license like Singapore (13O/13U). Instead, Family Offices operate as a Private Fund under a Notification Regime. This is faster and requires less regulatory approval.

What are the main differences between a Labuan Foundation and a Trust?

A Trust is a legal relationship (not a separate entity) where a Trustee holds assets. A Foundation is a corporate body (separate legal entity) that owns itself. Foundations are often preferred by Asian families because they offer more control and legal structure similar to a company.

Can I use a Labuan entity to buy Malaysian property?

Yes, but it is treated as a foreign entity. You may need state authority consent and minimum price thresholds (e.g., RM 1 Million+) apply. However, for Labuan Foundations, holding Malaysian assets is permitted and can be part of the endowment.

Do I strictly need an office in Labuan?

Yes, if you want the 3% tax rate. You must have a physical office (Registered Office via your Trust Company is not enough; you need a separate commercial space or dedicated desk) and employ staff. If you are non-tax resident (pay tax elsewhere), you may opt out of the 3% regime.

What is the minimum capital requirement?

Unlike Singapore (S$20M) or Hong Kong, Labuan has no minimum paid-up capital requirement for the Private Fund itself. You only need sufficient working capital to remain solvent and pay your annual fees.

Confused by SFO/MFO Architectures or Substance Rules?

Get bespoke 2026 compliance and implementation advice from the TIMELESS Family Office experts.

*Daily slots are limited. Please mention FIAM Guide when booking.

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning

Related Insights

Forest City SFO vs Labuan Trust vs Offshore Trust (2026)

Compare Forest City SFO (0% tax), Labuan trusts and offshore trusts. See AUM, substance, costs, layering strategies and best fit for Malaysians in 2026.

Family Office in Malaysia: 6 Major Reasons You Must Know Now

Family Office in Malaysia: Why You Must Know This Now (2026 Outlook) Last updated: 19 Feb 2026 Family Office Malaysia Forest City SFZ Family Office Incentive Scheme

Estate Planning in Malaysia: Will vs Trust vs Family Office

Importance of Estate Planning in Malaysia (2026): Will vs Trust vs Family Office Estate Planning Malaysia Will (Wasiat) Privat

The Truth About Labuan Family Offices: Is It Really an SFO?

Setup a Labuan Family Office in 2026. Compare Private Fund vs Waqf structures, understand requirements, and see the new FSA fee revisions.