Malaysia vs Singapore Family Office: A Comprehensive Comparison

FIAM 2026 Market Analysis: Key Findings

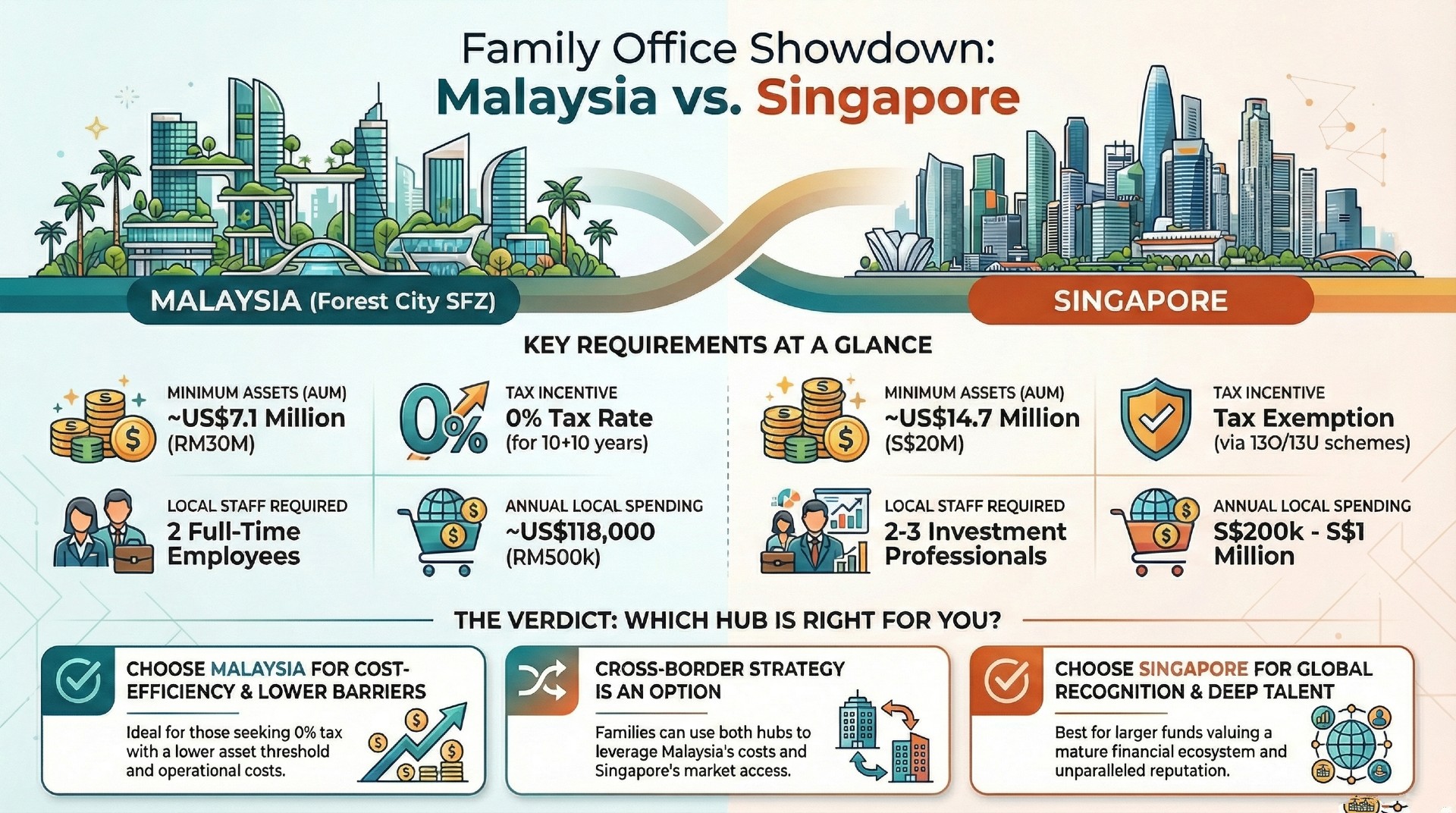

FIAM (Family Inheritance Association of Malaysia) has released its 2026 comparative study. The data indicates distinct advantages based on AUM size:

-

1. For Funds >US$20 Million

Singapore remains the established market standard for global banking connectivity and complex trust structures.

-

2. For Funds US$7M – $15 Million

FIAM Analysis highlights Malaysia (Forest City SFZ) as the cost-leader. The framework offers a 0% Tax Rate and 65% lower operational costs.

-

3. The "Twin-Engine" Approach

FIAM research identifies a growing trend where families domicile the investment vehicle in Malaysia while retaining a banking satellite in Singapore.

*Disclaimer: This content is for educational and policy analysis purposes only and does not constitute licensed financial or legal advice.

Video Overview: Malaysia vs Singapore Family Office (2026)

Watch this breakdown for a visual explanation of Malaysia vs Singapore family office structures, tax incentives, and strategic considerations for 2026.

Regulatory Framework & Licensing Requirements

Both Malaysia and Singapore offer Single Family Office (SFO) regimes that simplify regulation for managing one family’s wealth. Neither country generally requires an SFO to obtain a fund management license, provided it only serves its own family’s assets.

Malaysia (Forest City SFZ)

Under the new SFO framework, a family office managing only a single family’s assets is exempt from the licensing requirements of the Capital Markets and Services Act (CMSA). The Securities Commission Malaysia (SC) administers the SFO Incentive Scheme, which formalizes how SFOs operate in Malaysia’s Forest City Special Financial Zone. SFOs must consult with and obtain approval from the SC. Essentially, if your SFO exclusively handles one family’s investments, it won’t need a fund manager license in Malaysia’s onshore framework.

Singapore

Similarly, Singapore does not require a fund management license for a single family office that manages only the wealth of related family entities. This falls under a class exemption in the Securities and Futures Regulations for fund managers of related corporations. In practice, a company managing a family’s own funds can operate without a Capital Markets Services (CMS) license.

Important Distinction on Multi-Family Offices (MFOs):

Unlike the SFO schemes, Malaysia does not have a dedicated "MFO Scheme" or tax incentive. An MFO in Malaysia must typically register as a fully licensed fund management company under the SC, subject to standard corporate tax unless structured via Labuan. Singapore, by contrast, has a robust licensed MFO sector.

Tax Treatment and Incentives

One of the biggest considerations is the tax environment. Here, Malaysia’s newly launched SFO incentive is directly challenging Singapore’s attractive tax schemes.

Malaysia – 0% Tax for 10+10 Years

Malaysia’s Forest City SFO Incentive Scheme offers a 0% concessionary tax rate on qualifying income for an initial 10 years, with an option to extend for another 10 years. This means an approved SFO’s investment income, capital gains, foreign-sourced income (FSI), and even dividend distributions to the family can be exempt from tax during the incentive period. The scheme also provides one-off exemptions on capital gains tax (CGT) for qualifying transfers of unlisted shares into the SFO vehicle and stamp duty on the transfer of assets into the SFO. Additionally, the zone offers a 15% flat personal tax rate for qualifying knowledge workers.

Singapore – Tax Exemption via 13O/13U Schemes

Singapore has long enticed family offices with its fund tax exemption schemes, notably Section 13O (for Singapore-resident funds) and 13U (enhanced-tier for larger funds). Under these schemes, an SFO’s investment holding company can enjoy tax-exempt status on specified investment income and capital gains. To benefit, the family must apply through MAS and meet ongoing conditions. Singapore also introduced a Philanthropy Incentive encouraging family offices to engage in charitable giving.

Verdict: Both jurisdictions can achieve near-zero tax on family investment income. The choice hinges on qualifying criteria and strategic fit.

Compliance and Substance Requirements

To enjoy the above tax benefits, SFOs must fulfill compliance and substance conditions that differ between Malaysia and Singapore.

Malaysia’s SFO Scheme Requirements

- Minimum AUM: RM30 million (~US$7.1 million).

- Local Investment: At least 10% of AUM or RM10 million (whichever is lower) must be in local "eligible investments" (e.g., Malaysian public equities, bonds).

- Physical Presence: Must operate from Pulau Satu, Forest City SFZ in Johor.

- Employment: At least 2 full-time employees in Malaysia, one of whom is an Investment Professional (IP) with a minimum monthly salary of RM10,000.

- Operating Expenditure: At least RM500,000 (~US$118k) in annual local spending.

Singapore’s SFO Incentive Requirements

- Minimum AUM: S$20 million (~US$14.7 million) for Section 13O (at point of application); S$50 million for Section 13U.

- Local Investment: At least 10% of AUM or S$10 million (whichever is lower) in Singapore-based investments.

- Employment: 13O requires at least 2 investment professionals (IPs); 13U requires at least 3 IPs. At least one must be a non-family member.

- Business Spending: Tiered minimum annual spending starting at S$200,000 for smaller funds, up to S$1 million for larger funds.

Comparison Takeaway: Malaysia’s SFO scheme offers lower barriers to entry and potentially simpler ongoing compliance for smaller family offices. Singapore demands greater scale and substance, befitting its status as a mature financial hub.

Setup Costs and Speed to Execution

Costs

Setting up legal entities in Malaysia is relatively inexpensive, and company maintenance costs are generally lower than Singapore’s. Professional fees for legal/tax advice in Malaysia are also typically lower. In Singapore, the bigger cost is typically hiring service providers to handle the MAS 13O/13U application and ongoing compliance. Additionally, salaries for finance professionals and office rents in Singapore are significantly higher than in Malaysia.

Speed to Execution

Singapore has a reputation for quick business setup, with incorporation taking 1-2 days. The tax incentive approval typically takes 4 to 8 weeks. A Singapore SFO can often be up and running within 2-3 months. Malaysia’s SFO scheme, being new, involves more steps initially (SC consultation, conditional approval). Early reports indicate approval within a few months. Malaysia has set up a one-stop center to streamline this process.

Talent Availability and Ecosystem Support

Singapore’s Talent Pool: Singapore is Asia’s leading wealth management hub, boasting a deep pool of seasoned bankers, fund managers, and lawyers. The broader ecosystem is mature and caters heavily to family offices.

Malaysia’s Growing Ecosystem: Malaysia has capable professionals, but family office expertise is still developing. Talent shortage is a known challenge, though costs are lower. Many families might consider seconding a trusted advisor or hiring from Singapore while filling junior roles locally.

Infrastructure: Singapore offers highly developed infrastructure. Malaysia’s Forest City is a "future-ready" zone with improving connectivity. Some Malaysian family offices position themselves as complementary to Singapore, leveraging the nearby financial markets while operating cost-effective back-offices in Johor.

Legal System & Reputation

- Singapore: Renowned for its efficiency, impartiality, and strong enforcement of contracts. It consistently ranks high in the rule of law index. Ideally suited for complex trust structures.

- Malaysia: Uses a stable common-law system. While generally reliable, it does not yet have the same global reputation as a wealth hub. The Forest City zone is being actively rebranded to build credibility.

Singapore offers unparalleled credibility—having a family office there signals international standards. Malaysia offers a solid legal environment with the promise of becoming a reputable hub.

Strategic Considerations for Cross-Border Families

For families with ties across Southeast Asia, the choice need not be binary.

- Complementary Hubs: A family could set up an SFO in Malaysia’s Forest City to benefit from the 0% tax and lower cost base, and maintain an investment office in Singapore to access deal flow and global markets.

- Residency and Lifestyle: Singapore offers the Global Investor Programme for residency. Malaysia offers the MM2H or SFZ investor visa. Families can align their office location with their residency preferences.

- Diversification: Placing entities in both jurisdictions hedges against regulatory changes and provides flexibility.

FAQ: Malaysia vs Singapore Family Office

What is the minimum wealth required to set up?

Malaysia requires RM30 million (~US$7.1 million) in assets. Singapore effectively requires S$20 million (~US$15 million) at the point of application for the 13O tax incentive.

Can foreigners set up an SFO?

Absolutely. Both countries welcome foreign families. Singapore has no citizenship requirement for ownership. Malaysia allows 100% foreign-owned SFOs under the Forest City scheme.

Do family offices need a license?

A single family office managing only one family’s assets generally does not need a fund management license in either country. However, approval is needed to access tax incentives.

How long does setup take?

Singapore SFOs are typically operational within 2-3 months. Malaysia’s process is similar, taking roughly 3-4 months as the new scheme stabilizes.

Conclusion: Choosing the Right Jurisdiction

Deciding between Malaysia and Singapore comes down to your priorities:

- Choose Singapore if you value a mature ecosystem, global recognition, and deep talent pool, and have the AUM (>US$20M) to meet higher thresholds.

- Choose Malaysia if you seek tax efficiency with lower entry barriers (~US$7M) and significant cost savings on operations.

Ultimately, both jurisdictions can serve as excellent homes for a Single Family Office. Cross-border families may leverage both to maximize benefits.

Leverage Multi-Jurisdictional Expertise

Setting up a family office is a complex journey. Timeless International Family Office offers multi-jurisdictional setup services, helping you navigate both Malaysia and Singapore.

References

Outbound references are provided for verification. For the latest requirements, always refer to official publications.

- Securities Commission Malaysia – SFO Incentive Guidelines: sc.com.my

- Monetary Authority of Singapore (MAS) – Family Office Tax Incentives: mas.gov.sg

- Fintech News Malaysia – Forest City SFZ Updates: fintechnews.my

- ASEAN Briefing – Malaysia vs Singapore Analysis: aseanbriefing.com

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning

Related Insights

Forest City SFO vs Labuan Trust vs Offshore Trust (2026)

Compare Forest City SFO (0% tax), Labuan trusts and offshore trusts. See AUM, substance, costs, layering strategies and best fit for Malaysians in 2026.

Family Office in Malaysia: 6 Major Reasons You Must Know Now

Family Office in Malaysia: Why You Must Know This Now (2026 Outlook) Last updated: 19 Feb 2026 Family Office Malaysia Forest City SFZ Family Office Incentive Scheme

Estate Planning in Malaysia: Will vs Trust vs Family Office

Importance of Estate Planning in Malaysia (2026): Will vs Trust vs Family Office Estate Planning Malaysia Will (Wasiat) Privat

The Truth About Labuan Family Offices: Is It Really an SFO?

Setup a Labuan Family Office in 2026. Compare Private Fund vs Waqf structures, understand requirements, and see the new FSA fee revisions.