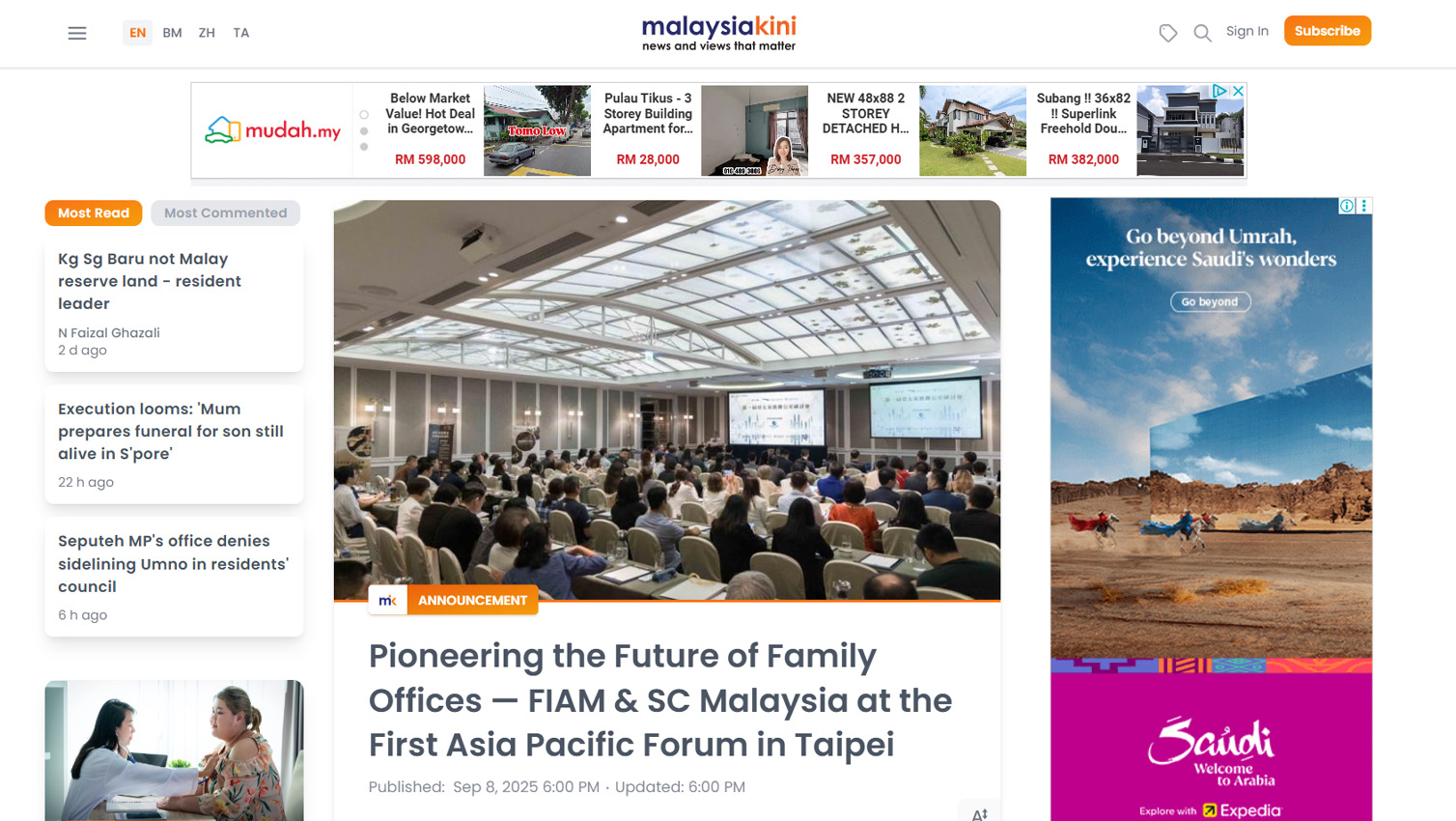

9 Important Reasons Malaysians Should Learn About Family Offices & Global Wealth Planning Now

Setting Up a Trust & Family Office: Strategic Wealth Planning for Future Generations

Why TIMELESS Family Office is a Strategic Wealth Partner for Malaysians

- International Expertise vs. Limited Local Knowledge

- Full Suite of Services Around the World

- Local Office and Personalised Service

Media Coverage

9 Important Reasons Malaysians Should Learn About Family Offices & Global Wealth Planning Now

On 20 September 2024, Malaysia officially launched Forest City as a Special Financial Zone (SFZ), as announced by Finance Minister II, YB Senator Datuk Seri Amir Hamzah Azizan.

Global family offices help sustain wealth across generations. Eduardo Saverin, Michael Dell, and Li Ka-Shing leveraged family offices for tax efficiency, investment diversification, and long-term wealth growth, showcasing their strategic benefits.

The number of Single Family Offices is projected to grow by 75%, reaching 10,720 by 2030. Their assets under management (AUM) are expected to rise from US$3.1 trillion to US$5.4 trillion, reflecting increasing global demand for structured wealth management.

MYR has depreciated up to 45% in the past decade, impacting asset value. Diversifying into multi-currency investments and global assets helps hedge against currency risks and preserve wealth.

Wealthy Malaysians have used global wealth structures for asset diversification and financial planning, including Lim Kok Thay, G Gnanalingam, Mahmud Abu Bekir, and Tiong Hiew King.

With high demand and global salaries rising, now is the time to gain expertise and capitalise on Malaysia’s family office talent gap.

With Bitcoin reaching a record high of over $109,000 in January 2025, safeguarding digital assets through secure storage solutions and regulatory compliance is crucial to mitigate cyber threats and market volatility.

Wealthy individuals protect their assets through strategic planning, diversification, and expert management to ensure long-term security and smooth wealth transfer.

ESG investing balances profits with sustainability and ethics. In Malaysia, rising AI-driven data centres prompt government ESG guidelines. Ethical wealth management ensures long-term, responsible investments

Read More about Family Office and Trust

Forest City SFO vs Labuan Trust vs Offshore Trust (2026)

Compare Forest City SFO (0% tax), Labuan trusts and offshore trusts. See AUM, substance, costs, layering strategies and best fit for Malaysians in 2026.

Family Office in Malaysia: 6 Major Reasons You Must Know Now

Family Office in Malaysia: Why You Must Know This Now (2026 Outlook) Last updated: 19 Feb 2026 Family Office Malaysia Forest City SFZ Family Office Incentive Scheme

Estate Planning in Malaysia: Will vs Trust vs Family Office

Importance of Estate Planning in Malaysia (2026): Will vs Trust vs Family Office Estate Planning Malaysia Will (Wasiat) Privat

The Truth About Labuan Family Offices: Is It Really an SFO?

Setup a Labuan Family Office in 2026. Compare Private Fund vs Waqf structures, understand requirements, and see the new FSA fee revisions.

Malaysia vs Singapore Family Office

Compare Malaysia vs Singapore Family Office setups for 2026. . A complete guide on licensing, AUM thresholds, and strategic benefits

How to Set Up Family Office in Malaysia

A comprehensive 2026 guide on how to set up a family office in Malaysia, covering structure, compliance, incentives, and cross-border options.

Discover comprehensive estate planning solutions in Malaysia with FIAM. Learn how wills, trusts, and family offices can prevent family disputes, ensure financial stability, and protect assets from creditors… Read More

In recent times, amid fluctuations in the Malaysian Ringgit (MYR) and shifts in the global financial landscape, offshore trust have emerged as a compelling option for Malaysian investors seeking to diversify their wealth… Read More

In Malaysia, Netflix’s “The Three-Body Problem” is one of the most popular TV shows currently. The Dark Forest Theory portrayed in it demonstrates a cautious attitude when facing unknown threats… Read More

Our Specialist

Ms Vicky Tan

General Manager

of Timeless International Family Office

Ms Diyana

of Timeless International Family Office

Mr Nic Lee

of Timeless International Family Office

Explore ways to safeguard your family's financial future with a complimentary 30-minute consultation (worth RM500)

Discover strategic wealth planning solutions tailored to your family’s needs with our complimentary consultation on trust structuring. We understand that every family has unique financial goals and challenges, requiring personalized approaches to long-term asset protection.

During your consultation, our experts will explore suitable trust structures aligned with your objectives, ensuring a smooth transition of wealth for future generations.

Schedule your free consultation today to gain insights into effective wealth preservation and legacy planning

Attend Our Monthly Event

- All Posts

- Blog

- Estate Planning

- insights

- Malaysian Offshore Trust

- Partner

- Post

Comprehensive exploration of Family Offices. Learn how Family Offices can offer enhanced asset protection, tax optimisation, and increased financial confidentiality...

Discover how offshore trust accounts can provide enhanced asset protection, tax efficiency, and financial privacy for individuals and families.

Why do we manage our money daily but only pay attention to our health once a year? This topic explores...

Premium financing has evolved from a product-driven conversation into a strategic capital tool within modern wealth planning. This session explores...

Past Seminars, Exclusive Talks & Networking Gatherings