FIAM’s president and Timeless International Family Office’s GM, Vicky, discusses family offices in Forest City on the ZFounder podcast. This post explores key insights for our English-speaking audience

Overview of Estate Planning (Will Writing, Malaysia Trust, and Offshore Trust)

Join our guest speaker, Ms. Julia Binti Mustaffa, Managing Director/CEO of Palladium Trustee Berhad, and an expert in estate planning, for a comprehensive session on how to manage and distribute your assets effectively.

Explore mREITs with Timeless

Exploration of mREITs focusing on secured creditor projects with real estate collateral in Southeast Asia. Learn how to effectively control risks while achieving stable fixed income.

The Importance of Offshore Trust Account

In-depth exploration of the Importance of Offshore Trust Accounts. Discover how offshore trust accounts can provide enhanced asset protection, tax efficiency, and financial privacy for individuals and families.

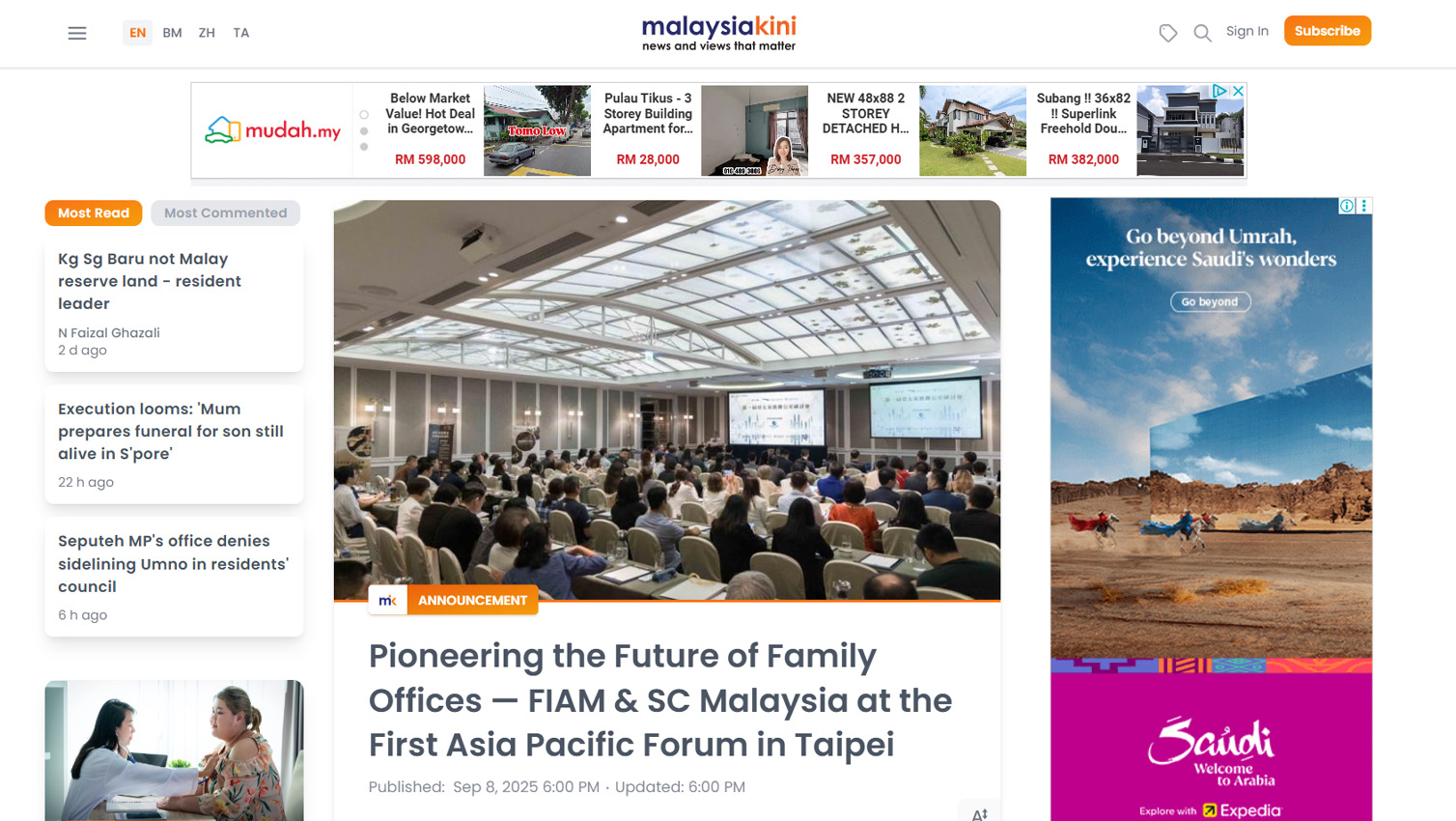

Multiply Your Wealth with Global Estate Planning Knowledge

Learn how leveraging global inheritance tools such as offshore trusts, family offices, and mREITs can secure your family’s financial future and ensure prosperity for generations to come.

Peluang Perniagaan – Business Opportunity

Peluang Perniagaan: Perhatian kepada ejen hartanah, pelaburan, dan insurans, serta individu yang bercita-cita tinggi! Rebut peluang emas ini untuk meningkatkan potensi jualan dan memperluaskan capaian anda. Ketahui bagaimana berkolaborasi dengan kami melalui peluang perniagaan ini dapat membawa kejayaan anda ke tahap yang luar biasa. Tempah tempat anda hari ini!