Building a Family Office Around Your Business: Family Office for Business Owners — Founder Control Guide (Malaysia & SEA) Founder Governance

and the eternity of continuation

About Us

Family Inheritance Association of Malaysia (FIAM) is legally established as a non-profit social group, aiming to align with national policies. It is composed of professionals and groups from industry, government, academia, and research institutions. The purpose is to enhance practical applications related to family inheritance planning, facilitate exchanges with international inheritance planning institutions, and engage with professionals in the field.

What We Do

Family Heritage Seminar

Family Asset Succession Planning Consultation

Family Philanthropy, Art, and Cultural Heritage

Succession and Equity Planning for Family Businesses

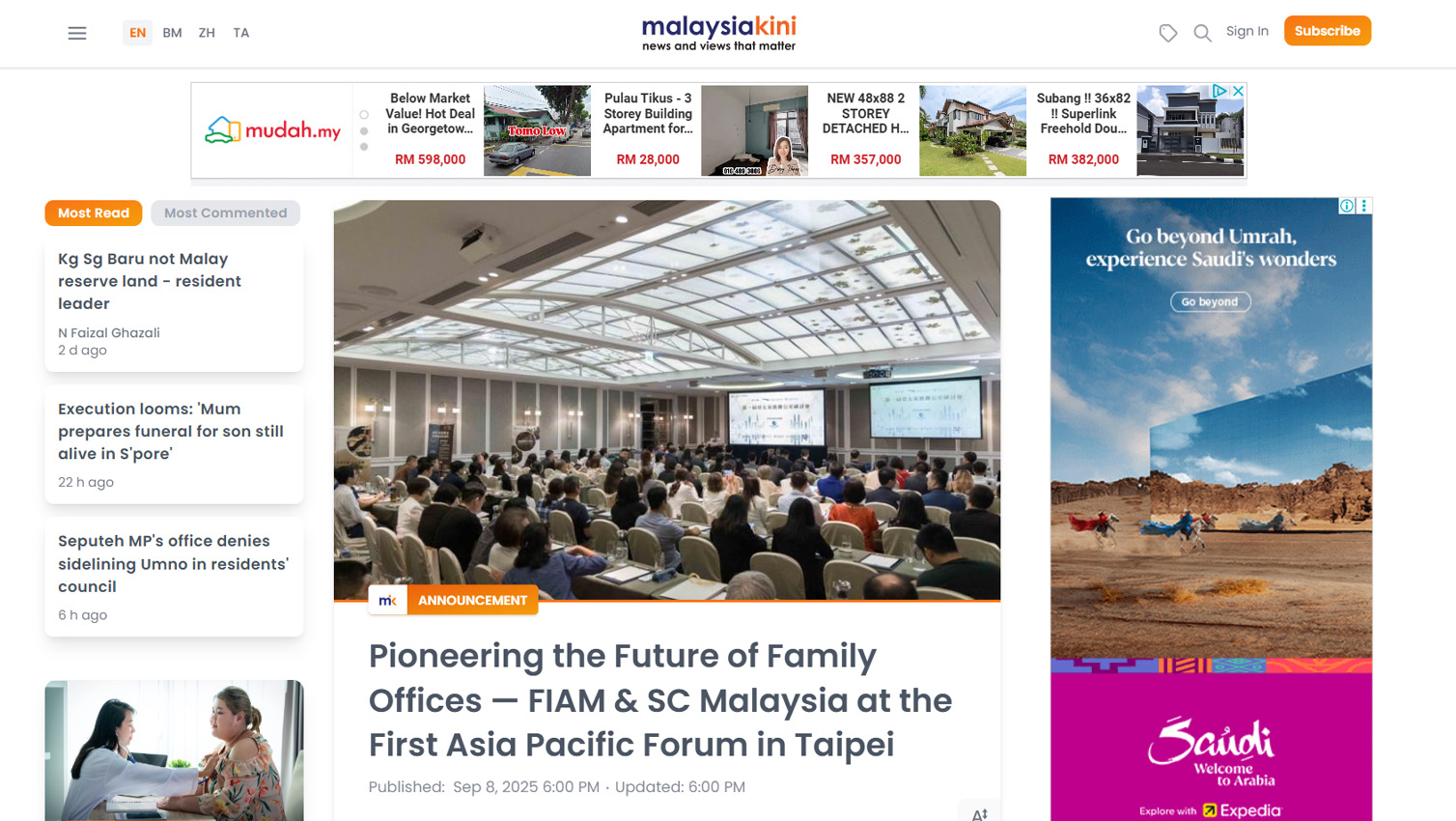

FIAM Recent Activities

- All Posts

- Blog

- Estate Planning

- insights

- Malaysian Offshore Trust

- Partner

- Post

Comprehensive exploration of Family Offices. Learn how Family Offices can offer enhanced asset protection, tax optimisation, and increased financial confidentiality...

Discover how offshore trust accounts can provide enhanced asset protection, tax efficiency, and financial privacy for individuals and families.

Why do we manage our money daily but only pay attention to our health once a year? This topic explores...

Premium financing has evolved from a product-driven conversation into a strategic capital tool within modern wealth planning. This session explores...

Media Coverage

Join Us Now

Embark on an exciting journey with us

Join us now for a better future that awaits you.

Insights

Forest City SFO vs Labuan Trust vs Offshore Trust (2026)

Compare Forest City SFO (0% tax), Labuan trusts and offshore trusts. See AUM, substance, costs, layering strategies and best fit for Malaysians in 2026.

Family Office in Malaysia: 6 Major Reasons You Must Know Now

Family Office in Malaysia: Why You Must Know This Now (2026 Outlook) Last updated: 19 Feb 2026 Family Office Malaysia Forest City SFZ Family Office Incentive Scheme

Estate Planning in Malaysia: Will vs Trust vs Family Office

Importance of Estate Planning in Malaysia (2026): Will vs Trust vs Family Office Estate Planning Malaysia Will (Wasiat) Privat

The Truth About Labuan Family Offices: Is It Really an SFO?

Setup a Labuan Family Office in 2026. Compare Private Fund vs Waqf structures, understand requirements, and see the new FSA fee revisions.

Malaysia vs Singapore Family Office

Compare Malaysia vs Singapore Family Office setups for 2026. . A complete guide on licensing, AUM thresholds, and strategic benefits

Discover comprehensive estate planning solutions in Malaysia with FIAM. Learn how wills, trusts, and family offices can prevent family disputes, ensure financial stability, and protect assets from creditors… Read More

In recent times, amid fluctuations in the Malaysian Ringgit (MYR) and shifts in the global financial landscape, offshore trust have emerged as a compelling option for Malaysian investors seeking to diversify their wealth… Read More

In Malaysia, Netflix’s “The Three-Body Problem” is one of the most popular TV shows currently. The Dark Forest Theory portrayed in it demonstrates a cautious attitude when facing unknown threats… Read More